How to Qualify for a Low-Interest Credit Card

admin

- 0

When it comes to managing your finances, having a low-interest credit card can be a game changer. Not only do these cards help you save money on interest charges, but they also offer a range of benefits and rewards. However, qualifying for a low-interest credit card can be a bit tricky, especially if you don’t…

Read More

The Benefits of Umbrella Insurance for Extra Protection

admin

- 0

In today’s fast-paced and unpredictable world, it’s more important than ever to protect yourself and your assets with the right insurance coverage. While most people are familiar with traditional types of insurance like auto, home, and health insurance, not everyone is aware of the benefits of umbrella insurance.

Read More

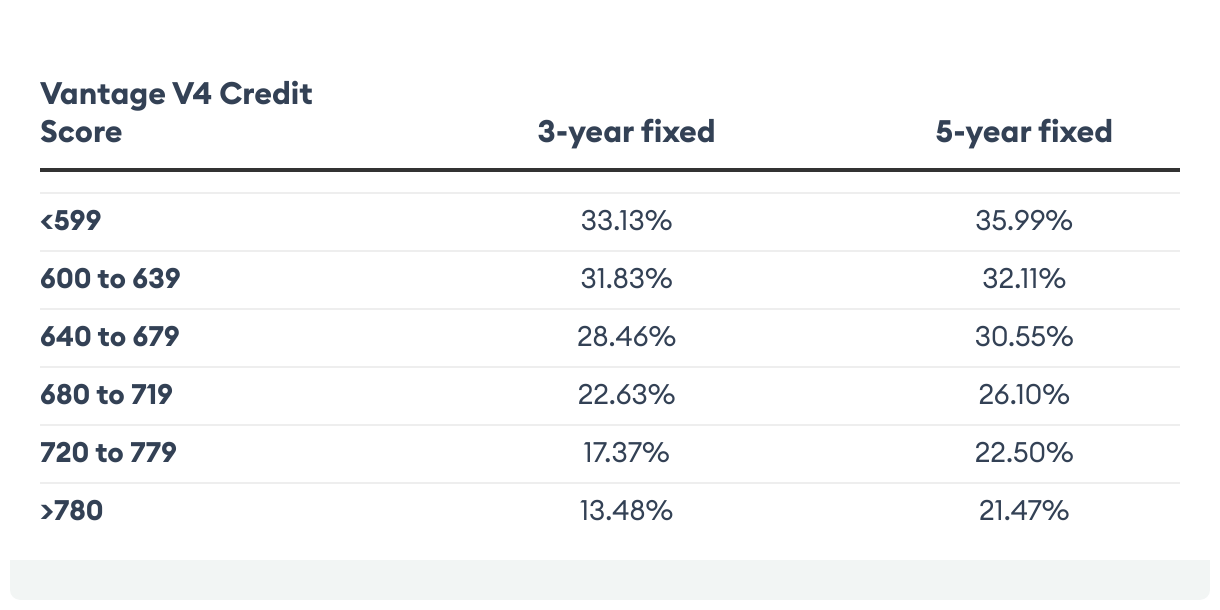

Understanding Fixed vs. Adjustable-Rate Mortgages

admin

- 0

When it comes to buying a home, one of the most important decisions you’ll need to make is choosing between a fixed-rate mortgage and an adjustable-rate mortgage. Both options have their own set of advantages and disadvantages, and understanding the differences between the two can help you make the best decision for your financial situation.

Read More

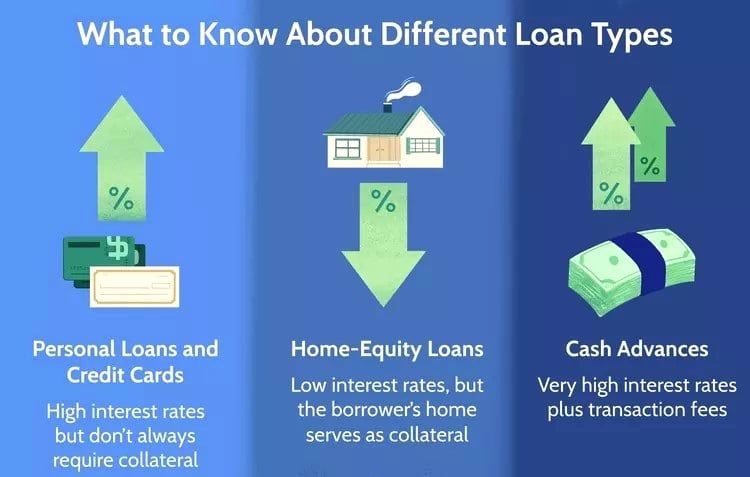

Understanding the Different Types of Loans

admin

- 0

When it comes to financing technology purchases, loans can be a key tool to help individuals and businesses acquire the latest technology without breaking the bank. However, navigating the world of loans can be overwhelming, with different types of loans catering to different needs. In this article, we will explore the various types of loans…

Read More

Best Investment Strategies for Growing Your Business

admin

- 0

As a tech entrepreneur, you understand the importance of investing in your business to drive growth and success. However, with so many options available, it can be challenging to determine the best investment strategies for your company. In this article, we will explore some key ways to strategically invest in your tech business for maximum…

Read More

How to Switch Banks Without Disrupting Your Finances

admin

- 0

Switching banks can seem like a daunting task, especially when it comes to ensuring that your finances remain intact throughout the process. However, with proper planning and organization, you can make a smooth transition to a new bank without any disruptions to your financial stability. In this guide, we’ll walk you through the steps you…

Read More

How to Choose the Best Mortgage for Your Needs

admin

- 0

When it comes to buying a home, one of the most important steps is choosing the right mortgage. With so many options available, it can be overwhelming to decide which one is best for your needs. In this article, we will discuss the key factors to consider when selecting a mortgage that suits your financial…

Read More

How to Choose the Best Mortgage Lender

admin

- 0

Choosing the best mortgage lender is a crucial decision when it comes to buying a home. With so many options available in the market, it can be overwhelming to find the right lender that suits your needs. In this article, we will provide you with some tips on how to choose the best mortgage lender…

Read More

Top 10 Personal Loan Options for 2024

admin

- 0

When it comes to financing your needs or fulfilling your dreams, personal loans can be a great tool to help you achieve your goals. In 2024, there are numerous personal loan options available to consumers, each with its own set of features and benefits. In this article, we will be discussing the top 10 personal…

Read More

Understanding Business Taxation: What You Need to Know

admin

- 0

Running a business is an exciting and rewarding endeavor, but it also comes with a lot of responsibilities, including understanding and managing your business taxes. As a business owner, it’s crucial to have a solid grasp of business taxation to ensure you are compliant with the law and maximizing your tax efficiency. In this article,…

Read More