Top 5 Strategies for Paying Off Debt Quickly

admin

- 0

Debt can be a heavy burden that weighs you down both financially and emotionally. If you’re looking to get out of debt quickly and start building wealth, it’s important to have a solid plan in place. In this article, we’ll discuss the top 5 strategies for paying off debt quickly so you can achieve financial…

Read More

How to Get Pre-Approved for a Mortgage Loan

admin

- 0

Are you in the market to buy a new home? One of the first steps you should take is to get pre-approved for a mortgage loan. This will give you a clear understanding of how much you can afford to borrow, helping you narrow down your search and making the home buying process smoother. In…

Read More

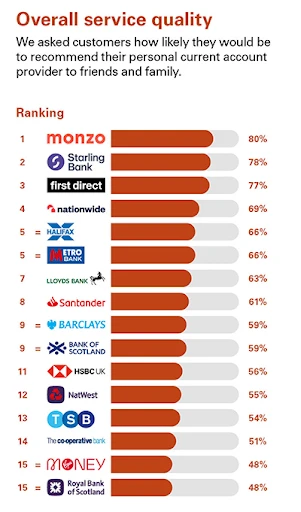

How to Avoid Bank Fees and Save More Money

admin

- 0

In today’s digital age, many of us rely heavily on our banks for everyday financial transactions. However, with that convenience comes a cost – bank fees. These fees can really add up over time and eat into your hard-earned money. But fear not! There are ways to avoid bank fees and save more money. Below…

Read More

How to Improve Your Chances of Loan Approval

admin

- 0

Securing a loan can be a daunting task, especially in today’s competitive financial landscape. Lenders have strict criteria when it comes to approving loans, and even the slightest mistake could result in a denial. However, there are several steps you can take to improve your chances of loan approval. In this article, we will discuss…

Read More

Top 10 Online Banks with the Best Interest Rates in 2024

admin

- 0

When it comes to managing your finances, online banks are becoming increasingly popular due to their convenience and competitive interest rates. In this article, we will highlight the top 10 online banks that offer the best interest rates in 2024.

Read More

How to Compare Car Insurance Quotes and Save Money

admin

- 0

When it comes to car insurance, finding the best deal can be a daunting task. With so many companies vying for your business and a plethora of coverage options to choose from, it’s easy to feel overwhelmed. However, by taking the time to compare car insurance quotes properly, you can save yourself a significant amount…

Read More

Best Practices for Managing Debt and Credit Cards

admin

- 0

Debt and credit cards are common financial tools that many people use in their everyday lives. However, if not managed properly, debt and credit cards can quickly spiral out of control and lead to financial hardship. That’s why it’s essential to have a clear understanding of best practices for managing debt and credit cards.

Read More

Top Real Estate Investment Strategies for 2024

admin

- 0

Real estate investment is a lucrative opportunity that can provide significant returns if done right. With the constantly evolving market trends and economic conditions, it is essential to stay ahead of the curve and adapt your investment strategies accordingly. In this article, we will discuss some of the top real estate investment strategies for 2024…

Read More

How to Secure Venture Capital for Your Startup

admin

- 0

For many entrepreneurs, securing venture capital is a crucial step in turning their startup dreams into reality. Venture capital not only provides the funding needed to grow and scale a business, but it also brings valuable expertise, resources, and connections to the table. However, securing venture capital is no easy feat. Competition is fierce, and…

Read More

The Benefits of High-Yield Savings Accounts

admin

- 0

When it comes to saving money, one of the best options available to consumers today is a high-yield savings account. These accounts offer a number of benefits that can help individuals reach their financial goals faster and more efficiently. In this article, we will explore some of the key advantages of high-yield savings accounts and…

Read More