What You Need to Know About Renter’s Insurance

admin

- 0

When you rent a home or apartment, it’s important to protect yourself and your belongings. Renter’s insurance can provide you with the financial security you need in case of theft, damage, or accidents. In this article, we will discuss everything you need to know about renter’s insurance.

What is Renter’s Insurance?

Renter’s insurance is a type of insurance that provides coverage for your personal belongings and liability protection. It covers your personal property in case of theft, fire, vandalism, or natural disasters. It also protects you in case someone is injured on your property and you are found liable.

Why Do You Need Renter’s Insurance?

Many renters mistakenly believe that their landlord’s insurance will cover their personal belongings in case of damage or theft. However, this is not the case. Your landlord’s insurance only covers the building itself, not your personal property. Renter’s insurance provides you with the protection you need to replace your belongings in case of a disaster.

What Does Renter’s Insurance Cover?

Renter’s insurance typically covers the following:

Personal property: This includes your furniture, electronics, clothing, and other belongings.

Liability protection: This covers you in case someone is injured on your property and you are found liable.

Additional living expenses: If your home becomes uninhabitable due to a covered loss, renter’s insurance can cover your living expenses while you find temporary housing.

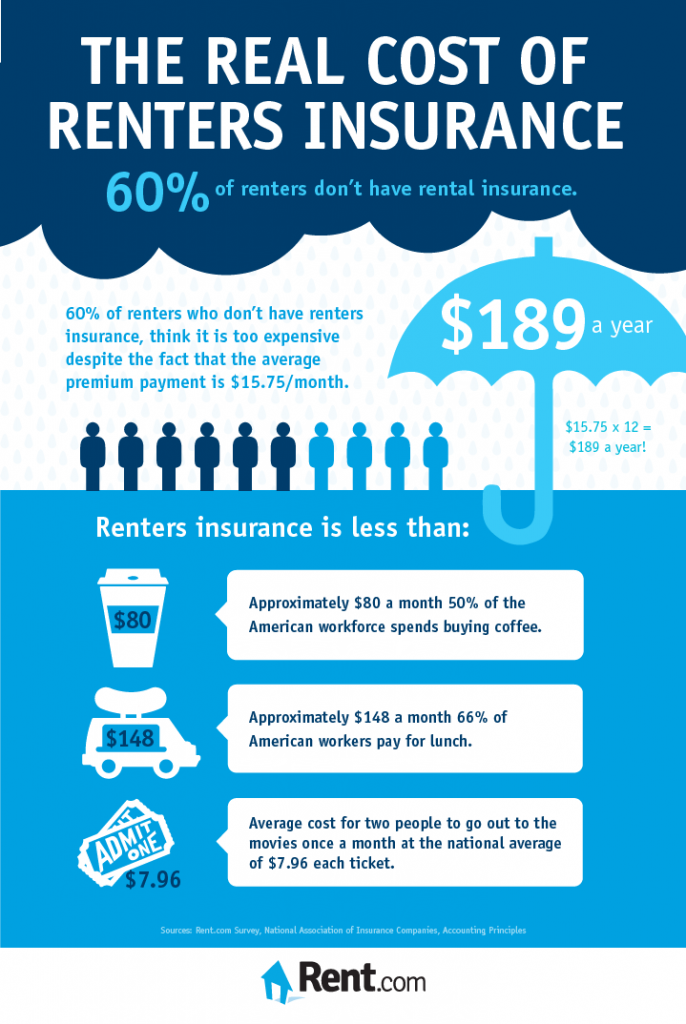

How Much Does Renter’s Insurance Cost?

The cost of renter’s insurance can vary depending on several factors, such as the amount of coverage you need, where you live, and your deductible. On average, renter’s insurance costs around $15-30 per month, making it an affordable option for most renters.

How to Buy Renter’s Insurance?

Buying renter’s insurance is a simple process. You can typically purchase it online or through an insurance agent. Before buying a policy, make sure to assess the value of your belongings and determine how much coverage you need. You can also customize your policy by adding endorsements for additional coverage.

Conclusion

Renter’s insurance is a crucial form of protection for renters. It provides you with the financial security you need to replace your belongings in case of theft, damage, or accidents. By understanding what renter’s insurance covers and how to buy it, you can make an informed decision to protect yourself and your belongings.