Understanding the Mortgage Process: A Complete Guide

admin

- 0

Buying a home is one of the most significant financial decisions you will make in your lifetime. Understanding the mortgage process is crucial to ensure a smooth and successful home buying experience. In this guide, we will take you through the entire mortgage process, from pre-approval to closing.

Pre-Qualification and Pre-Approval

Before you start looking for a home, it’s essential to get pre-qualified and pre-approved for a mortgage. Pre-qualification is an informal process where a lender gives you an estimate of how much you can borrow based on your income, assets, and debt. Pre-approval is a more formal process where a lender verifies your financial information and credit score to determine the amount you are approved to borrow.

Choosing the Right Mortgage

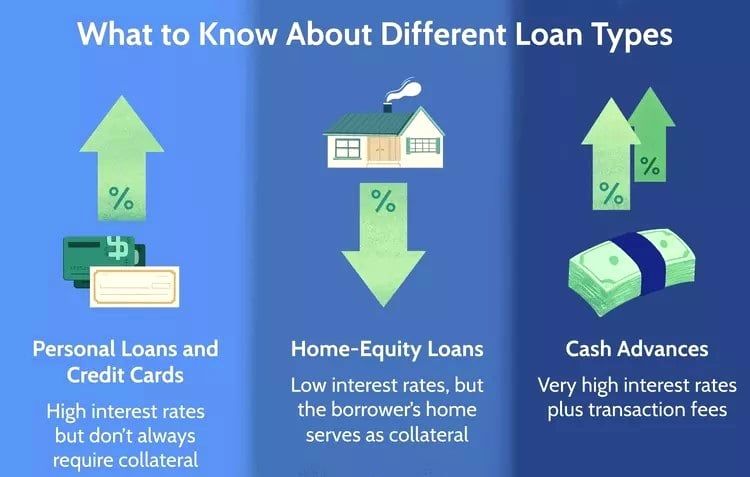

There are several types of mortgages available, including fixed-rate mortgages, adjustable-rate mortgages, FHA loans, VA loans, and more. It’s crucial to understand the pros and cons of each type of mortgage and choose the one that best suits your financial situation and long-term goals.

Applying for a Mortgage

Once you have chosen the right mortgage, you will need to complete a mortgage application and provide documentation such as pay stubs, bank statements, and tax returns. The lender will review your application and documentation to determine if you qualify for the loan.

Underwriting Process

During the underwriting process, the lender will verify the information provided in your application and documentation. They will also assess your creditworthiness and ability to repay the loan. This process can take several weeks, so it’s essential to be patient and responsive to any requests for additional information.

Home Appraisal and Inspection

As part of the mortgage process, the lender will require a home appraisal to determine the value of the property. They will also likely require a home inspection to ensure the property is in good condition and free of any major defects. These steps help protect both you and the lender from purchasing a property that is overpriced or has significant issues.

Closing Process

Once the lender has approved your mortgage, you will move on to the closing process. This is where the final paperwork is signed, and the property ownership is transferred to you. You will need to pay closing costs, which can include fees for loan origination, title insurance, and other services. It’s crucial to review all closing documents carefully and ask any questions you may have before signing.

Conclusion

Understanding the mortgage process is essential for a successful home buying experience. By following this guide and working with a knowledgeable lender, you can navigate the mortgage process with confidence and secure the financing you need to purchase your dream home.