Understanding the Different Types of Loans

admin

- 0

When it comes to financing technology purchases, loans can be a key tool to help individuals and businesses acquire the latest technology without breaking the bank. However, navigating the world of loans can be overwhelming, with different types of loans catering to different needs. In this article, we will explore the various types of loans available for tech purchases and how to choose the right one for your specific situation.

1. Personal Loans

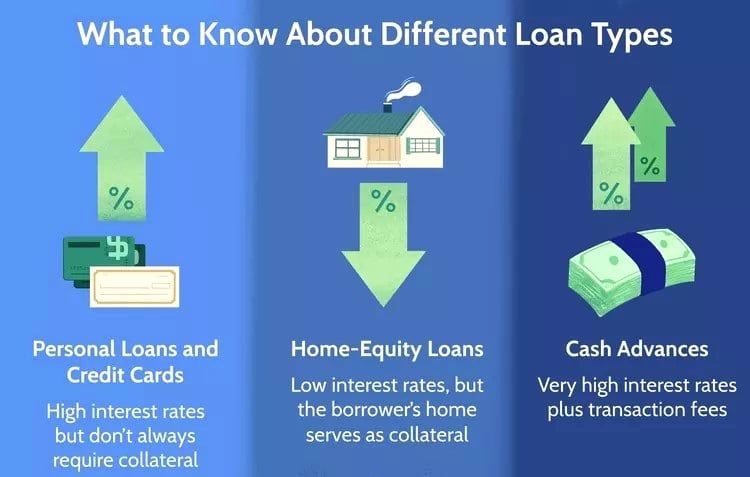

Personal loans are one of the most common types of loans used to finance technology purchases. These loans are unsecured, meaning they do not require any collateral, and can be used for a variety of purposes, including buying a new laptop, smartphone, or other tech gadgets. Personal loans typically have fixed interest rates and monthly payments, making them a predictable and manageable financing option.

2. Business Loans

For businesses looking to invest in technology upgrades, equipment financing or business loans can be a valuable option. Business loans are specifically designed for businesses and can be used to purchase computers, software, servers, and other tech equipment needed to improve productivity and competitiveness. These loans often have flexible repayment terms and can be tailored to the unique needs of a business.

3. Equipment Financing

Equipment financing is another popular option for financing technology purchases. This type of loan allows individuals and businesses to acquire the latest tech equipment without needing to pay the full cost upfront. Equipment financing typically involves leasing or renting the equipment for a specified period, with the option to purchase it at the end of the term. This can be a cost-effective way to access technology without tying up capital.

4. Credit Cards

While not technically a loan, credit cards can also be a useful tool for financing technology purchases. Many credit cards offer rewards programs, cash back incentives, or 0% interest introductory periods that can make them an attractive option for buying tech gadgets. However, it’s important to carefully manage credit card purchases to avoid high interest rates and fees.

5. Peer-to-Peer Lending

Peer-to-peer lending platforms have emerged as an alternative to traditional bank loans for financing technology purchases. These platforms connect borrowers directly with individual investors, cutting out the middleman and potentially offering lower interest rates. Peer-to-peer lending can be a good option for individuals with less-than-perfect credit who may have difficulty qualifying for a bank loan.

6. Crowdfunding

For tech startups or innovative projects, crowdfunding can be a creative way to raise funds for technology purchases. Platforms like Kickstarter and Indiegogo allow individuals to pitch their ideas to a wide audience and secure funding from backers. This can be a great option for emerging technologies or products that may not fit the traditional loan model.

Conclusion

Choosing the right type of loan for your technology purchase requires careful consideration of your financial situation, credit history, and specific needs. Whether you opt for a personal loan, business loan, equipment financing, credit card, peer-to-peer lending, or crowdfunding, it’s important to do your research, compare loan terms and interest rates, and select the option that best fits your budget and goals. With the right financing in place, you can acquire the technology you need to stay competitive and innovative in today’s tech-driven world.