How to Compare Car Insurance Quotes and Save Money

admin

- 0

When it comes to car insurance, finding the best deal can be a daunting task. With so many companies vying for your business and a plethora of coverage options to choose from, it’s easy to feel overwhelmed. However, by taking the time to compare car insurance quotes properly, you can save yourself a significant amount of money in the long run. Here are some tips to help you navigate the process and find the best coverage at the most affordable price.

Understand Your Coverage Needs

Before you start comparing car insurance quotes, it’s essential to understand your coverage needs. Consider factors such as your driving habits, the age and value of your vehicle, and your budget. Knowing what you need in terms of coverage will help you narrow down your options and make a more informed decision.

Shop Around

One of the most effective ways to save money on car insurance is by shopping around and comparing quotes from multiple providers. Websites like Insurify, Compare.com, and The Zebra allow you to compare quotes from different insurance companies quickly and easily. Be sure to get quotes from at least three different providers to ensure you’re getting the best price.

Look for Discounts

Many insurance companies offer discounts for various reasons, such as safe driving, bundling policies, or having safety features in your vehicle. Be sure to inquire about any discounts that may be available to you when comparing car insurance quotes. These discounts can add up to significant savings over time.

Consider Your Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Generally, the higher your deductible, the lower your premium will be. However, be sure to choose a deductible that you can afford in the event of an accident. Consider your financial situation and weigh the pros and cons of a higher deductible before making a decision.

Review the Coverage Options

When comparing car insurance quotes, be sure to review the coverage options offered by each provider carefully. Different companies may offer different levels of coverage, so it’s essential to understand what you’re getting for your money. Consider factors such as liability coverage, collision coverage, and comprehensive coverage when making your decision.

Check the Reputation of the Insurance Company

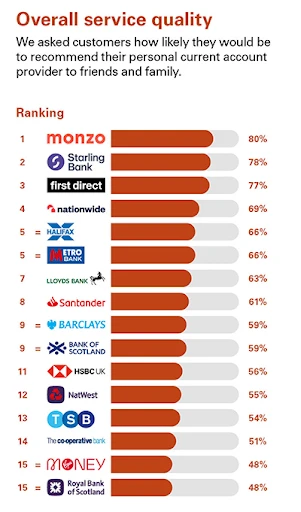

Before making a decision, be sure to research the reputation of the insurance company you’re considering. Look for customer reviews, ratings, and complaints to get a sense of how well they treat their policyholders. A company with a good reputation is more likely to provide excellent customer service and support when you need it most.

Final Thoughts

Comparing car insurance quotes may seem like a time-consuming process, but the potential savings are well worth the effort. By following these tips and taking the time to shop around, you can find the best coverage at the most affordable price. Remember to consider your coverage needs, shop around, look for discounts, consider your deductible, review the coverage options, and check the reputation of the insurance company before making a decision. With a little research and due diligence, you can save money on car insurance without sacrificing quality coverage.

So don’t wait any longer – start comparing car insurance quotes today and see how much you can save!