How to Choose the Best Mortgage Lender

admin

- 0

Choosing the best mortgage lender is a crucial decision when it comes to buying a home. With so many options available in the market, it can be overwhelming to find the right lender that suits your needs. In this article, we will provide you with some tips on how to choose the best mortgage lender for your next home purchase.

Research and Compare

One of the first steps in choosing the best mortgage lender is to research and compare your options. Look at different lenders, their interest rates, loan terms, and customer reviews. Make sure to compare at least three to five different lenders to get a good idea of what each one offers.

Check Lender’s Reputation

It’s important to check the reputation of the mortgage lender you are considering. Read customer reviews, visit the lender’s website, and check their ratings with the Better Business Bureau. A reputable lender will have a history of providing excellent customer service and transparent lending practices.

Consider the type of Lender

There are different types of mortgage lenders, including banks, credit unions, mortgage brokers, and online lenders. Each type of lender has its own advantages and disadvantages. For example, banks may offer lower interest rates but have stricter lending requirements, while mortgage brokers can provide more personalized service but may charge higher fees. Consider what type of lender best fits your needs and financial situation.

Understand the Loan Terms

Before choosing a mortgage lender, make sure to thoroughly understand the loan terms they are offering. This includes the interest rate, loan term, down payment requirements, closing costs, and any other fees associated with the loan. Ask questions and request a written loan estimate to compare the terms from different lenders.

Get Pre-Approved

Getting pre-approved for a mortgage is a crucial step in the home buying process. It shows sellers that you are a serious buyer and can help you stand out in a competitive market. Most lenders offer pre-approval letters that state the amount you are qualified to borrow based on your income, credit score, and other financial factors.

Ask for Recommendations

If you are unsure where to start, ask for recommendations from friends, family, or a real estate agent. They may have worked with reputable mortgage lenders in the past and can provide you with valuable insights and recommendations.

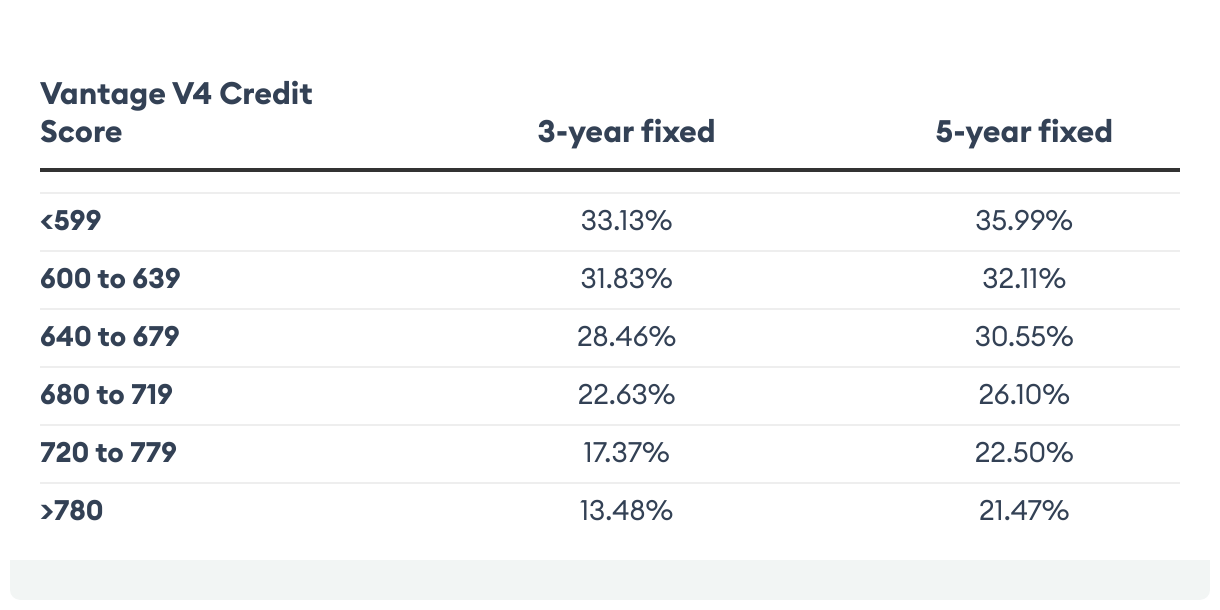

Compare Interest Rates

One of the most important factors to consider when choosing a mortgage lender is the interest rate they offer. Even a slight difference in interest rates can have a significant impact on your monthly mortgage payments and the total cost of the loan over time. Compare interest rates from different lenders to find the best deal for your financial situation.

Read the Fine Print

Before signing any loan documents, make sure to read the fine print and understand all the terms and conditions of the loan. Pay attention to any prepayment penalties, adjustable interest rates, or other potential fees that may impact your loan in the future. If you have any questions or concerns, don’t hesitate to ask your lender for clarification.

Conclusion

Choosing the best mortgage lender is a crucial step in the home buying process. By researching and comparing different lenders, understanding the loan terms, and getting pre-approved, you can find the right lender that meets your needs and financial goals. Remember to consider the lender’s reputation, type of lender, and interest rates before making a decision. With these tips in mind, you can confidently choose the best mortgage lender for your next home purchase.