Category: Business Finance

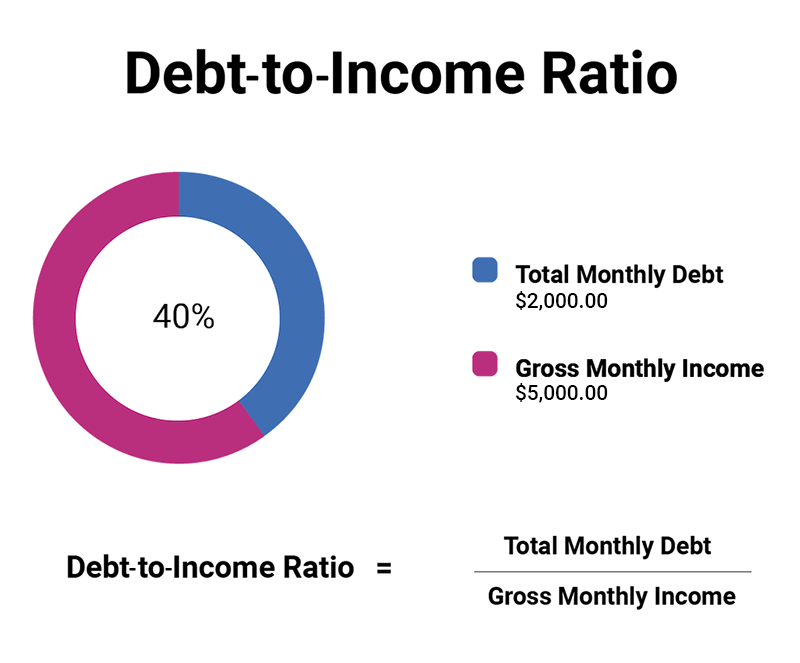

How to Calculate Your Debt-to-Income Ratio for a Mortgage

admin

- 0

When it comes to getting approved for a mortgage, one of the key factors that lenders look at is your debt-to-income ratio. Your debt-to-income ratio is a measure of how much of your monthly income goes towards paying off debts, such as credit card bills, car loans, and student loans. By calculating your debt-to-income ratio,…

Read More

The Pros and Cons of Refinancing Your Home

admin

- 0

Refinancing your home can be a smart financial move that can save you money in the long run. However, there are also downsides to consider before making a decision. In this article, we will explore the pros and cons of refinancing your home.

Read More

Best Loan Options for Real Estate Investors

admin

- 0

Real estate investing can be a lucrative venture, but it often requires a significant amount of capital upfront. For many investors, taking out a loan is a necessary step to fund their real estate projects. However, with so many loan options available, it can be overwhelming to determine which one is the best fit for…

Read More

How to Get Pre-Approved for a Mortgage Loan

admin

- 0

Are you in the market to buy a new home? One of the first steps you should take is to get pre-approved for a mortgage loan. This will give you a clear understanding of how much you can afford to borrow, helping you narrow down your search and making the home buying process smoother. In…

Read More

Top Real Estate Investment Strategies for 2024

admin

- 0

Real estate investment is a lucrative opportunity that can provide significant returns if done right. With the constantly evolving market trends and economic conditions, it is essential to stay ahead of the curve and adapt your investment strategies accordingly. In this article, we will discuss some of the top real estate investment strategies for 2024…

Read More

Understanding Fixed vs. Adjustable-Rate Mortgages

admin

- 0

When it comes to buying a home, one of the most important decisions you’ll need to make is choosing between a fixed-rate mortgage and an adjustable-rate mortgage. Both options have their own set of advantages and disadvantages, and understanding the differences between the two can help you make the best decision for your financial situation.

Read More

How to Choose the Best Mortgage Lender

admin

- 0

Choosing the best mortgage lender is a crucial decision when it comes to buying a home. With so many options available in the market, it can be overwhelming to find the right lender that suits your needs. In this article, we will provide you with some tips on how to choose the best mortgage lender…

Read More