Category: Blog

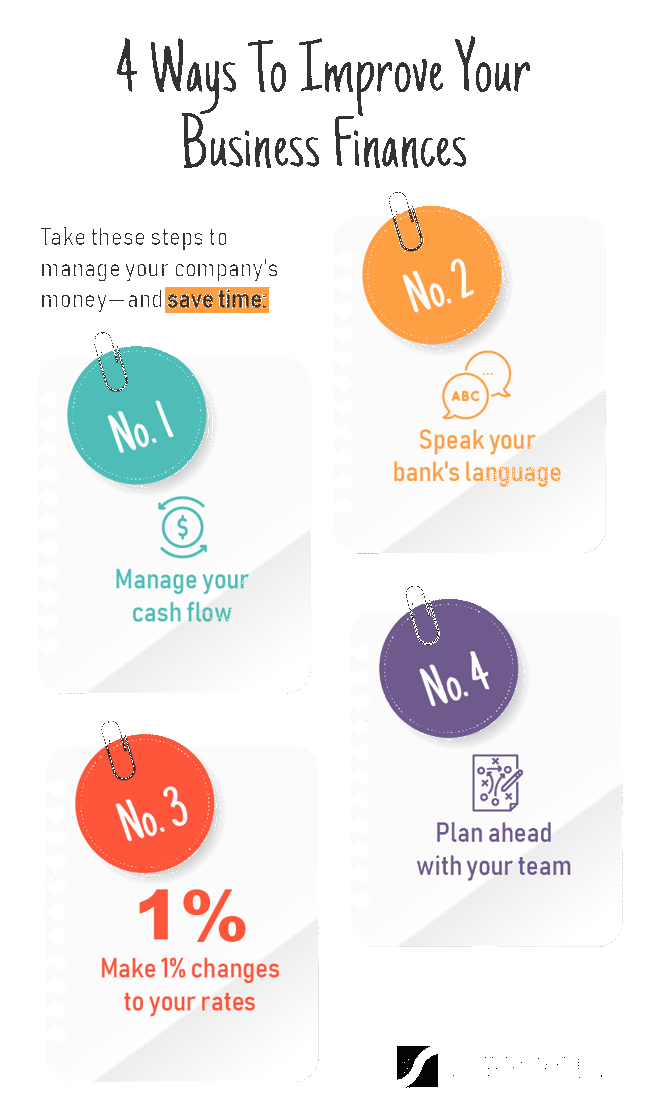

How to Manage Cash Flow for Business Success

admin

- 0

Having a solid grasp on cash flow management is crucial for the success of any business, especially in the tech industry where rapid growth and fluctuations in revenue are common. Without proper cash flow management, even the most innovative tech startups can quickly find themselves struggling to stay afloat. In this article, we will discuss…

Read More

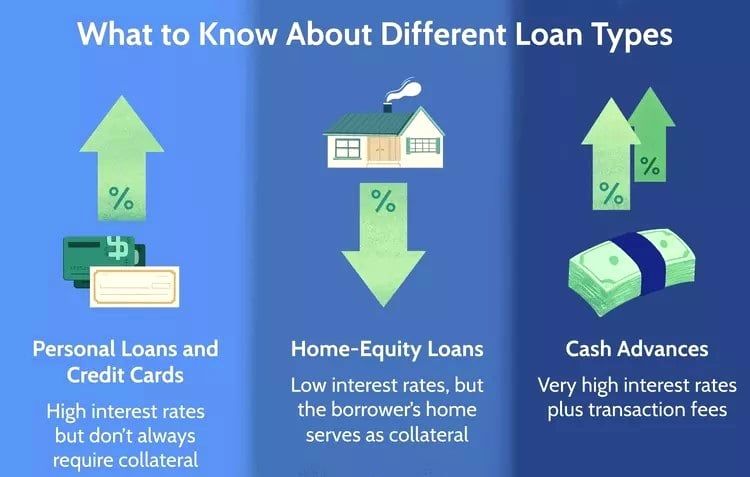

Best Business Loan Options for Entrepreneurs in 2024

admin

- 0

Starting a new business or expanding an existing one requires funding, and for many entrepreneurs, securing a business loan is the way to go. In 2024, there are several options available for entrepreneurs to consider when looking for financing. In this article, we will explore some of the best business loan options for entrepreneurs in…

Read More

How to Create a Solid Financial Plan for Your Business

admin

- 0

Running a successful business requires more than just a great product or service. Having a solid financial plan in place is crucial for the long-term success and sustainability of your business. In this article, we will discuss the key steps to creating a comprehensive financial plan for your business.

Read More

Top 10 Financial Tips for Small Business Owners

admin

- 0

Running a small business can be both rewarding and challenging. As a business owner, you need to be able to effectively manage your finances in order to ensure the success and longevity of your company. Here are 10 financial tips to help you navigate the world of small business finance:

Read More

The Pros and Cons of Taking Out a Payday Loan

admin

- 0

Payday loans have become a popular option for many individuals who find themselves in need of quick cash. These short-term loans are typically used to cover unexpected expenses or bridge the gap between paychecks. However, like any financial decision, there are both pros and cons to consider before taking out a payday loan.

Read More

How to Compare Loan Offers and Interest Rates

admin

- 0

When it comes to taking out a loan, one of the most important factors to consider is the interest rate. The interest rate on a loan can have a significant impact on how much you end up paying over time. With so many lenders offering different loan options and interest rates, it can be overwhelming…

Read More

Understanding the Mortgage Process: A Complete Guide

admin

- 0

Buying a home is one of the most significant financial decisions you will make in your lifetime. Understanding the mortgage process is crucial to ensure a smooth and successful home buying experience. In this guide, we will take you through the entire mortgage process, from pre-approval to closing.

Read More

Top 5 Strategies for Paying Off Debt Quickly

admin

- 0

Debt can be a heavy burden that weighs you down both financially and emotionally. If you’re looking to get out of debt quickly and start building wealth, it’s important to have a solid plan in place. In this article, we’ll discuss the top 5 strategies for paying off debt quickly so you can achieve financial…

Read More

How to Improve Your Chances of Loan Approval

admin

- 0

Securing a loan can be a daunting task, especially in today’s competitive financial landscape. Lenders have strict criteria when it comes to approving loans, and even the slightest mistake could result in a denial. However, there are several steps you can take to improve your chances of loan approval. In this article, we will discuss…

Read More

Best Practices for Managing Debt and Credit Cards

admin

- 0

Debt and credit cards are common financial tools that many people use in their everyday lives. However, if not managed properly, debt and credit cards can quickly spiral out of control and lead to financial hardship. That’s why it’s essential to have a clear understanding of best practices for managing debt and credit cards.

Read More