How to Calculate Your Debt-to-Income Ratio for a Mortgage

admin

- 0

When it comes to getting approved for a mortgage, one of the key factors that lenders look at is your debt-to-income ratio. Your debt-to-income ratio is a measure of how much of your monthly income goes towards paying off debts, such as credit card bills, car loans, and student loans. By calculating your debt-to-income ratio, you can get a better understanding of your financial health and how much of a mortgage you can afford.

What is Debt-to-Income Ratio?

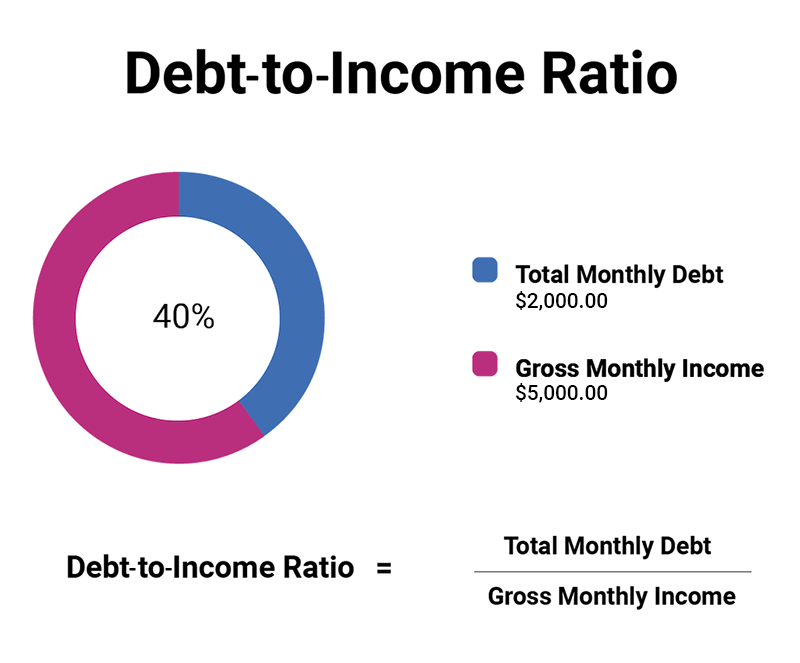

Your debt-to-income ratio is a simple calculation that lenders use to determine how much of your monthly income is going towards debt payments. It is calculated by dividing your total monthly debt payments by your gross monthly income. For example, if you have a total of $1,500 in monthly debt payments and your gross monthly income is $5,000, your debt-to-income ratio would be 0.3 or 30%.

Why is Debt-to-Income Ratio Important?

Lenders use your debt-to-income ratio to assess your ability to manage your monthly payments and determine how much of a mortgage you can afford. A lower debt-to-income ratio indicates that you have more disposable income to put towards a mortgage payment, making you a less risky borrower. On the other hand, a higher debt-to-income ratio may signal that you are overextended and may have trouble making your mortgage payments.

How to Calculate Your Debt-to-Income Ratio

To calculate your debt-to-income ratio, follow these simple steps:

Make a list of all your monthly debt payments, including credit card bills, car loans, student loans, and any other debt obligations.

Add up all of your monthly debt payments to get your total monthly debt amount.

Calculate your gross monthly income, which is your total income before taxes and other deductions.

Divide your total monthly debt amount by your gross monthly income to get your debt-to-income ratio.

For example, if your total monthly debt payments are $1,500 and your gross monthly income is $5,000, your debt-to-income ratio would be 0.3 or 30%.

What is Considered a Good Debt-to-Income Ratio?

Typically, lenders look for a debt-to-income ratio of 43% or lower. However, some lenders may be willing to go higher depending on other factors such as your credit score and down payment amount. It is important to keep in mind that your debt-to-income ratio is just one of many factors that lenders consider when determining your mortgage eligibility.

Improving Your Debt-to-Income Ratio

If your debt-to-income ratio is higher than the recommended 43%, there are a few ways you can improve it:

Pay off existing debts to reduce your total monthly debt amount.

Increase your income by taking on a part-time job or freelancing gigs.

Avoid taking on new debt, such as credit card purchases or car loans.

By improving your debt-to-income ratio, you can increase your chances of getting approved for a mortgage and secure a better interest rate.

Conclusion

Calculating your debt-to-income ratio is an important step in the mortgage process, as it helps lenders assess your ability to manage your monthly payments and determine how much of a mortgage you can afford. By following the steps outlined in this article and improving your debt-to-income ratio, you can increase your chances of getting approved for a mortgage and secure a better interest rate. Remember, your debt-to-income ratio is just one piece of the puzzle, so make sure to consider other factors such as your credit score and down payment amount when applying for a mortgage.