How to Manage Cash Flow for Business Success

admin

- 0

Having a solid grasp on cash flow management is crucial for the success of any business, especially in the tech industry where rapid growth and fluctuations in revenue are common. Without proper cash flow management, even the most innovative tech startups can quickly find themselves struggling to stay afloat. In this article, we will discuss…

Read More

How to Choose the Right Business Insurance Policy

admin

- 0

As a business owner, protecting your investment is crucial. One of the most important ways to safeguard your business from unexpected events is by having the right insurance coverage. With the myriad of insurance options available, choosing the right business insurance policy can be overwhelming. In this guide, we will walk you through the key…

Read More

Top 5 Banking Apps for Easy Money Management

admin

- 0

Managing your finances has never been easier thanks to the convenience of banking apps. With just a few taps on your smartphone, you can easily check your account balance, transfer funds, pay bills, and much more. In this article, we will take a look at the top 5 banking apps that are highly recommended for…

Read More

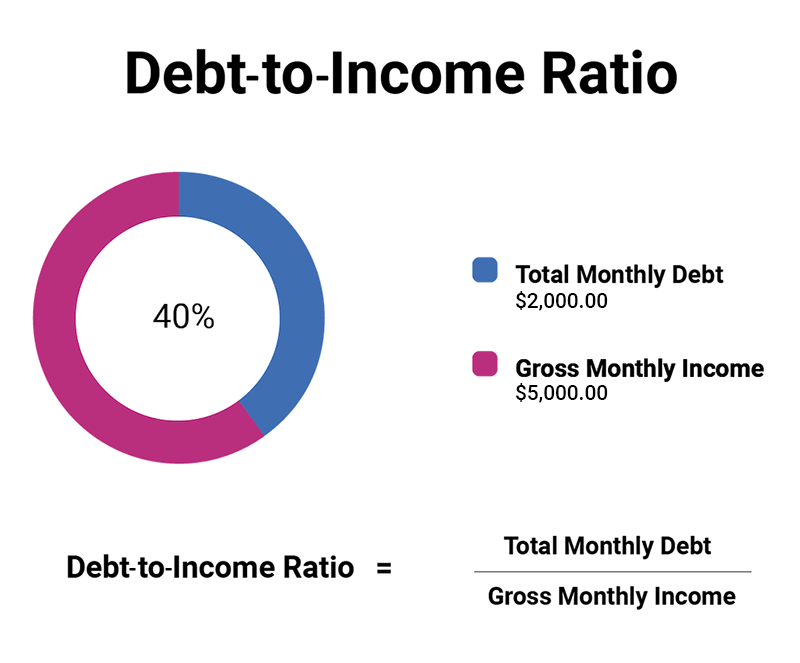

How to Calculate Your Debt-to-Income Ratio for a Mortgage

admin

- 0

When it comes to getting approved for a mortgage, one of the key factors that lenders look at is your debt-to-income ratio. Your debt-to-income ratio is a measure of how much of your monthly income goes towards paying off debts, such as credit card bills, car loans, and student loans. By calculating your debt-to-income ratio,…

Read More

Best Business Loan Options for Entrepreneurs in 2024

admin

- 0

Starting a new business or expanding an existing one requires funding, and for many entrepreneurs, securing a business loan is the way to go. In 2024, there are several options available for entrepreneurs to consider when looking for financing. In this article, we will explore some of the best business loan options for entrepreneurs in…

Read More

Top 10 Tips for Financing Your First Home

admin

- 0

Buying your first home is an exciting milestone, but it can also be overwhelming, especially when it comes to financing. With so many options available, it can be challenging to know where to start. In this article, we will provide you with the top 10 tips for financing your first home, so you can navigate…

Read More

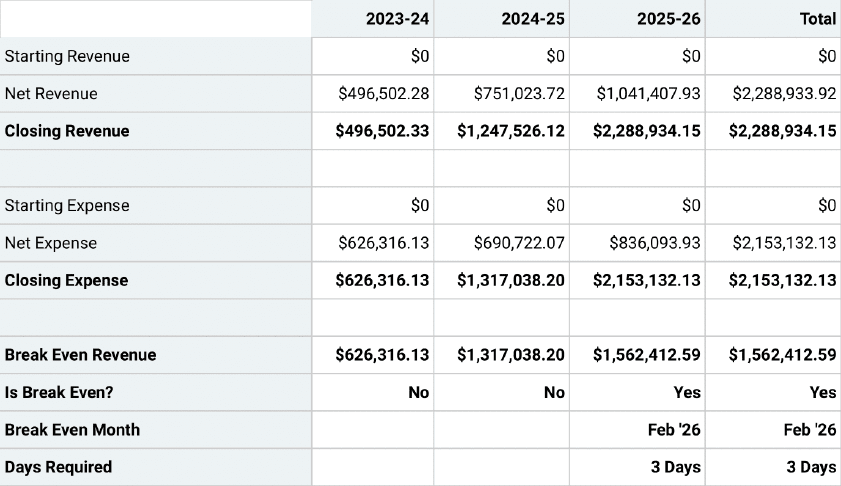

How to Create a Solid Financial Plan for Your Business

admin

- 0

Running a successful business requires more than just a great product or service. Having a solid financial plan in place is crucial for the long-term success and sustainability of your business. In this article, we will discuss the key steps to creating a comprehensive financial plan for your business.

Read More

The Pros and Cons of Refinancing Your Home

admin

- 0

Refinancing your home can be a smart financial move that can save you money in the long run. However, there are also downsides to consider before making a decision. In this article, we will explore the pros and cons of refinancing your home.

Read More

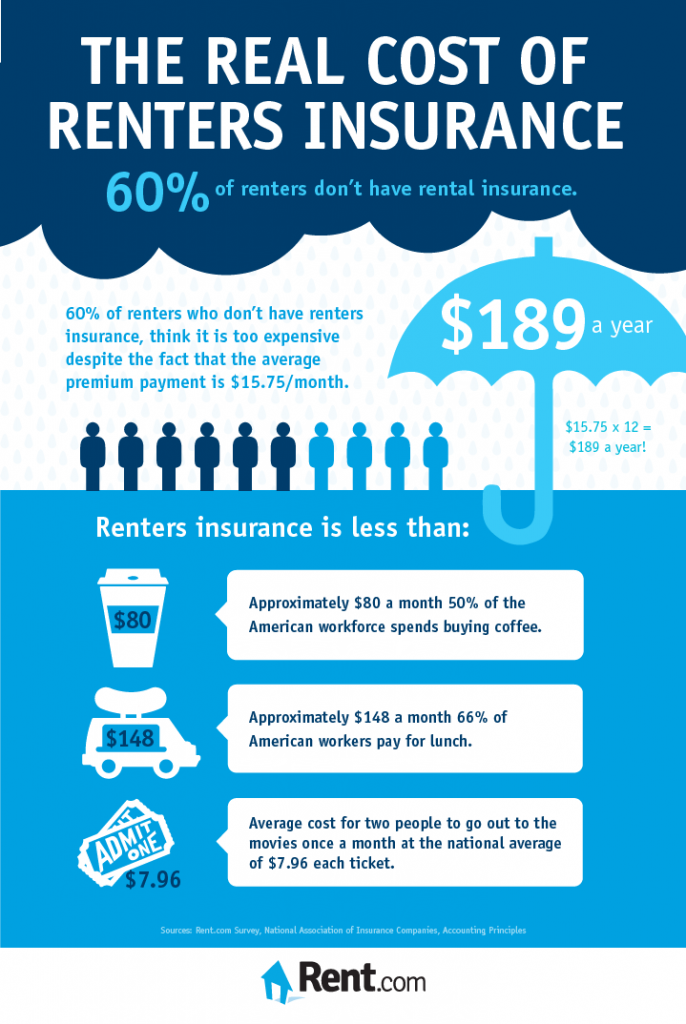

What You Need to Know About Renter’s Insurance

admin

- 0

When you rent a home or apartment, it’s important to protect yourself and your belongings. Renter’s insurance can provide you with the financial security you need in case of theft, damage, or accidents. In this article, we will discuss everything you need to know about renter’s insurance.

Read More

Understanding the Differences Between Checking and Savings Accounts

admin

- 0

When it comes to managing your finances, having a good understanding of the differences between checking and savings accounts is essential. These two types of accounts serve different purposes and offer different benefits to account holders. In this article, we will explore the key differences between checking and savings accounts.

Read More